User Experience Engineering

Friday, December 27, 2013

Google Should Buy Inuit, Crush PayPal

I wrote that Google is Going After PayPal with Google Wallet. What would be Google's natural next step? Google is a few components away from owning the money round trip: POS devices, mobile payment devices, bill presentment, and personal finance. Google could acquire Inuit, get all of those, sell you a mortgage, and prepare your taxes.

Intuit has its own cash-register size POS system and mobile payments device GoPayment. It has announced integration with Square via Square-Quickbooks integration. It has freebie Mint.com, and three paid tiers of the mobile-plus-desktop Quicken 2014.

Intuit has its own cash-register size POS system and mobile payments device GoPayment. It has announced integration with Square via Square-Quickbooks integration. It has freebie Mint.com, and three paid tiers of the mobile-plus-desktop Quicken 2014.

|

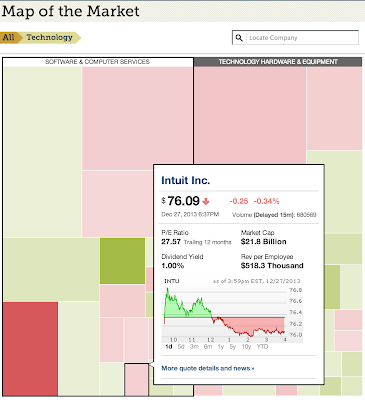

| That big green rectangle in the top left is Google, at $373B http://www.marketwatch.com/tools/stockresearch/marketmap |

Money Required

Intuit would cost less than Ebay, and more than recent Google acquisition Motorola. Square is arguably already on-track for an acquisition, given its recent integration to blood rival Intuit.

- $373B - Google Market Cap

- $70B - Ebay Market Cap (including PayPal)

- $21.8B - Inuit Market Cap

- $12.4B - Google acquired Motorola for $40/share

- $341M - Square Total Funding

People Have Said So Over Time

I'm far from the first to make this connection. Some have said that it will not happen because of the antitrust precedent set by the Microsoft attempt to acquire Intuit.

- Donna Bogatin in March and August 2007.

- Andrew Carr in 2007

"...in 1995, Microsoft tried to acquire Intuit, only to be thwarted by the Justice Department's antitrust regulators. (That marked the real beginning of Microsoft's legal woes.) Even though, in the long run, Google could end up an even bigger monopoly than Microsoft, I don't think it would run into antitrust problems if it tried to buy Intuit today. (If it waits, though, all bets are off.)" - http://www.marketingpilgrim.com/2007/03/should-google-buy-intuit-or-freshbooks.html

Now, it is much more of a group show. If ever there was a time that Google could acquire Intuit, and claim it was not a monopoly, it is now.

Sure, Android OS has 81% marketshare, but most Android is not on a Google/Motorola device. In fact, Google/Motorola are not even ranked in Gartner's latest article on smartphone marketshare. The newest Kindle Fire HDX is an Android device owned by Amazon, and used to promote its content. Apple is the largest corporation of any kind on the Market Map, and takes 56% of the mobile profit. A great argument can be made that Google is avoiding antitrust issues by being everywhere, and sharing its technologies.

The only question remaining is will Google build or buy the parts of its payment flow machine? They could acquire one or more of the Google Apps vendors with related technology. They might be building their own, and choosing to reveal it when the quality is impeccable. They are playing their long game again.

But, the easiest route to owning the cash register is buying Intuit and Square. It's not too late.

Are you a medium-sized business? Intuit has an army of resellers that can hook you up with the "full POS" solution; software, hardware, and integration.

Are you a small business? Amazon has the the whole shebang in a box.

And separately.

Are you a mom-and-pop brick and mortar? Sam's Club has the software.

Comments:

Chromebook is at 20% notebook marketshare. It's harder to make the "monopoly" charges stick until that number is 50+%...

Post a Comment

Google Wallet Targeting Paypal Head-on

Google has made no secret of its universal and generalized payment technology ambitions. Now, it is spending ad money to position Google Wallet directly against PayPal. Here is an example ad appearing in Gmail:

PayPal has a healthy head start, according to comScore, Forrester, and VentureBeat. Google has some things that eBay/PayPal lacks.

Pay your friends back - www.google.com/wallet - Right from your Gmail inbox. Skip having to split the bill

- Ubiquity - Google is integrated practically everywhere.

- Big Data necessary to speak to location, pricing, reviews.

- A mobile phone company of its own: Motorola.

- Google Apps - personal and business.

- Brand Reputation * - a history of following the principle, "Don't be evil", versus a history of complaints.

- Free Labor and Channel Control

- Mash-up ease - Google has made a great many APIs available, and welcomes incoming technology in Google Gadgets, except gadgets that take money.

- Publishing platforms with a longterm policy that accept Google Gadgets, and mostly reject custom scripting.

- Head starts in nonprofit and mobile giving: Google Nonprofits, One Today

- Respectable presence in eCommerce: Google Shopping

- Google Ads

- Google Analytics

It is difficult to say which of these advantages is greatest. If I were going to build my non-auction business on one or the other, I'd choose Google. Google could search and sell my product or service(1,6), advertise it (9), provide an integrated suite for reporting, CRM, VRM (4, 10), and push the wallet to mobile devices it owns (3). PayPal may be the most recognizable or trusted wallet brand. I would argue that Google is a more trusted brand overall.

*Brand Reputation

One could argue that PayPal has a substantial head start at creating ill will. I have my own biases about both companies. To casually quantify or qualify the reputations, I used Yahoo search, factoring out the possibilities of a Google Search bias against Paypal, and a Bing bias against Google. Look at the qualitative difference in result content: Paypal complaints. (2.52M results on Yahoo) Google Complaints (1.75M). One could easily dismiss the quantitative difference, because PayPal has been around longer, and might be accumulating complaints at the same rate. However, most Internet users have received some services from Google for free. PayPal and eBay have long been associated with gray market transactions. eBay recently won a Supreme Court ruling, having been implicated in a copyright infringement case.Mash-ups and Publishing

The publishing platforms may represent digital sharecropping or progressive use of cognitive surplus, depending on your point of view. The same can be said of mash-ups, which could be viewed as free integration code, or invention-on-spec. It would be tough to argue that either is not powerful or popular. The policies against scripts and Gadgets that take money speak to Google's agenda. PayPal's agenda has been more explicit from the start.

I have an idea of what would wipe out PayPal's head start over Google Wallet...

I have an idea of what would wipe out PayPal's head start over Google Wallet...

Archives

March 2006 May 2006 July 2006 August 2006 January 2007 March 2007 April 2007 August 2007 March 2008 April 2008 August 2008 April 2010 May 2010 July 2010 September 2010 April 2011 November 2012 March 2013 December 2013